In the world of finance and investment, Premium Bonds have long been a subject of debate.

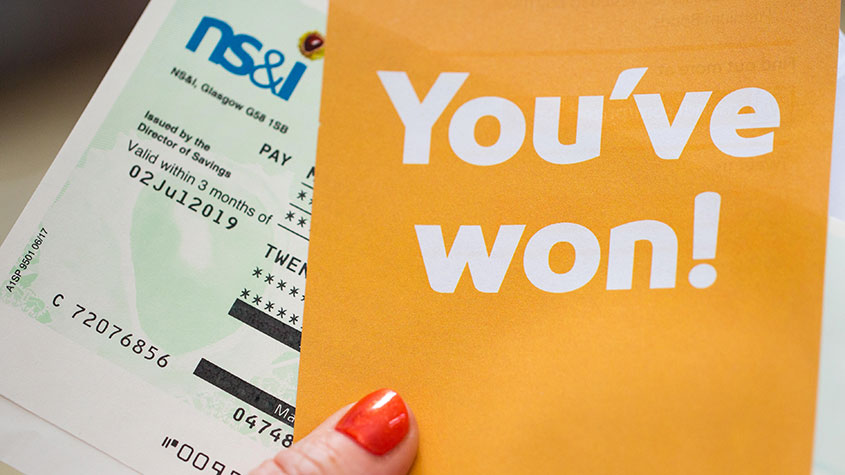

These instruments, offered by the UK government’s National Savings and Investments (NS&I) agency, function as a type of lottery-based savings account.

The question often arises: are Premium Bonds a form of gambling, or are they risk-free?

On this page, we will dive into the details of Premium Bonds, analyse their nature and provide a comprehensive answer to this question.

What Are Premium Bonds?

Premium Bonds are a unique financial product offered by the National Savings and Investments (NS&I), an agency of the UK government. These bonds are not traditional investment vehicles; rather, they function as a lottery-based savings account.

With every Premium Bond purchased, instead of earning regular interest or dividends, the buyer gains an opportunity to win tax-free prizes through regular draws. These prizes range from £25 to a whopping £1 million. Therefore, they can be viewed as a hybrid of a savings account and a lottery.

Introduced in 1956, Premium Bonds were initially aimed at encouraging people to save money and support the post-World War II economy in the United Kingdom. Today, they are considered the UK’s largest savings product, with millions of individuals having invested over £120 billion in them.

Are Premium Bonds a Form of Gambling?

The comparison of Premium Bonds to gambling is not entirely baseless. After all, both involve an element of chance or luck.

When you buy Premium Bonds, you’re essentially placing your money into a pool with the hope of winning a prize, much like purchasing a lottery ticket or placing a bet.

However, there are some key differences that set Premium Bonds apart from traditional forms of gambling.

In gambling, there’s always a risk of losing your initial stake. Whether you’re at a slot machine, betting on a horse race, or partaking in a game of poker, there’s always the possibility that you might lose more than you can afford.

On the contrary, with Premium Bonds, even if you never win a prize, you can always reclaim your original investment, making it essentially risk-free.

Therefore, while Premium Bonds do share similarities with gambling, they are fundamentally an investment tool. The element of chance is present, but so is the security of your initial capital.

Discover The Best Online Casinos

Browse our list of top-recommended casino sites, read reviews from real players & be the first to get access to the latest casino bonuses

What Are Premium Bonds Classed As?

Premium Bonds are categorised as a type of lottery bond. They are a financial product sold by NS&I, structured as savings accounts.

Every £1 invested in Premium Bonds earns you a unique bond number, and each bond number is entered into a monthly prize draw.

Instead of accumulating interest, your bond numbers provide you with a chance to win tax-free prizes each month.

On the surface, this might seem like gambling, but it’s crucial to remember that you never lose your original investment with Premium Bonds. Whether you win or not, your capital remains intact. This safety net is what sets Premium Bonds apart from typical forms of gambling and classifies them as an investment product.

Are Premium Bonds Risk Free?

When it comes to the safety of your capital, Premium Bonds are indeed risk-free. They are backed by the UK government, which ensures 100% security of your savings.

The money you invest in Premium Bonds can be withdrawn at any time, and even if you never win a prize, you can always reclaim your original investment.

However, it’s important to understand the concept of risk in a broader context. While your initial investment is secure, Premium Bonds do not offer a guaranteed return.

The return on your investment is entirely dependent on whether you win a prize.

Furthermore, the value of your investment may be eroded by inflation over time, especially if you don’t win any prizes. Therefore, while Premium Bonds are risk-free in terms of capital security, they do carry an element of risk in terms of potential returns.

Do You Have To Declare Premium Bond Winnings?

One of the significant advantages of Premium Bonds is that the prizes are tax-free. This means that if you win a prize, you don’t have to pay income tax or capital gains tax on your winnings.

However, Premium Bonds are not exempt from inheritance tax. If you pass away, your estate may be required to pay tax on the value of your bonds.

It’s also important to note that while the prizes are tax-free, you must still declare any winnings to the tax authorities. This is particularly relevant if you’re a non-resident and purchase UK Premium Bonds.

The Bottom Line

Overall, while Premium Bonds share certain similarities with gambling, they are fundamentally a type of investment product. They offer a unique way of saving money, with the potential for significant tax-free prizes, while ensuring the security of your initial investment.

If you’re comfortable with the element of chance and understand the risks associated with potential returns, Premium Bonds can be an exciting and rewarding addition to your investment portfolio.